By Haroon Khan, CPA, CA (Canada), CPA (USA)

To simplify tax matters, we have prepared a course on Underused Housing Tax (UHT) regulations in Canada. We have received a lot of queries regarding the impact of rules on jointly owned properties by citizens and Permanent residents, particularly when spouses are involved. This blog explains the features of UHT rules. It analyzes whether the joint ownership of a spousal property is defined as a partnership or not.

This blog discusses one specific issue within the UHT rules. For a more comprehensive understanding, we invite you to enroll in our course (link provided below)

Determining UHT Applicability

If you aim to understand how UHT rules affect the ownership of your property, first you must know whether you are an “excluded” owner or an “affected” owner.

Excluded Owners; If a Canadian citizen or permanent resident owns a residential property individually then they are an excluded owner and the UHT rules do not apply.

Affected Owners; To be considered as an affected owner, the following circumstances may apply:

- A Canadian citizen or permanent resident owns a property as a trustee of a trust.

- A Canadian citizen or permanent resident is one of the owners, in a partnership.

Clarifying Spousal Property Ownership and Partnership

Usually, spouses own properties jointly. However, an important question is; According to the rules of UHT, do spouses qualify as partners in the ownership of a property? The Canada Revenue Agency (CRA) provides some insights into this matter in their UHT Notice#15.

- CRAs Perspective on Partnership (Question 1.4); It can be complex to look for the definition of a partnership according to UHTA as they do not explicitly define it. However, the CRA recognizes the relationship under the law to determine if it is a partnership. In Canadas self-assessment tax system individuals are responsible for determining these facts themselves.

- CRAs Perspective on Joint Ownership (Question 1.5); If spouses jointly own a property, it does not automatically mean it constitutes a partnership. Some provincial laws specifically state that joint ownership does not imply partnership regardless of any sharing of profits.

- CRAs Perspective on Form T776 (Question 1.7); Even though the UHTA and Income Tax Act operate independently, but if two common-law partners define a partnership on Form T776 for income tax purposes they cannot claim a different relationship for UHT purposes.

Determining Partnership Status

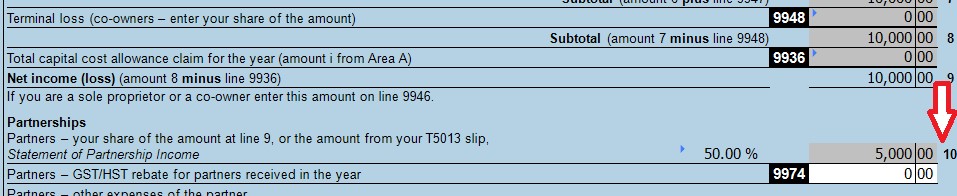

Many people have been confused about whether they filed Form T776 as a partnership or not. One reason, for this confusion is that when they see a printed version of Form T776 they notice a “%” symbol in the “your percentage of the partnership” box under Part 1 – Identification.

However regardless of whether it entered as “co-owners” or “partnership” this box will always display “50%”. As such, it is not a good way to check.

To understand if you filed a T776 form as a partnership, go to Part 4 and see Box 10, if the box has a number, it means it was filed as a partnership. If Box 10 is empty, the form was not filed as a partnership.

Joint owners have a tough time understanding the Underused Housing Tax Rules. Differentiating between excluded and affected owners, familiarizing with CRA guidelines on the characterization of partnerships is crucial. However, if you are looking for an in-depth understanding of changes and their implications, we recommend considering enrollment in our course and getting CPD hours.

https://www.cpdhours.com/recent-updates-underused-housing-tax-real-estate-transactions