By: Haroon Khan, CPA, CA (Canada), CPA (USA)

In this blog post, we will be discussing the importance of obtaining a business number, from the Canada Revenue Agency (CRA) in a timely manner. Over the years due to the absence of business numbers, foreign clients had a tough time meeting deadlines as a result they had to face numerous penalties

The CRA business number acts as your identification within Canada. It is vital for compliance with tax laws, without this number you are non-existent to the CRA. This number is required for the following purposes:

1. Establishing employment contracts.

2. Acquiring tax waivers (RC473 and Regulation 105) within Canada.

3. Receiving payments from customers.

4. Remitting withholding taxes for your employees.

5. Completing tax returns and informational slips in Canada.

6. Charging taxes (GST/HST) on invoices issued to customers.

7. Claiming input tax credits/refunds, for GST/HST paid within Canada.

How to Register for a CRA Business Number for Non-Resident Businesses?

If you are a business there are two methods to register for a CRA business number, register for payroll, GST/HST, and corporate tax accounts.

1. The easiest and most convenient option is to contact us at info@ictax.ca. Once you reach out we will provide you with a questionnaire that requires completion. We will then handle the submission of your application on your behalf. If you are, from a non-English speaking country, it is important to have your articles of incorporation translated into English before submitting your application. This will help avoid any delays.

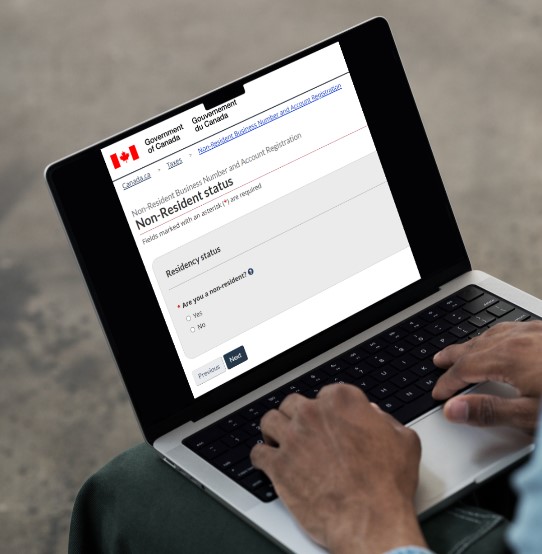

2. You also have the choice to apply for these accounts online personally following the instructions given by the CRA through this link.

The CRA usually takes 3 to 4 weeks to issue a business number. Therefore, you should apply for the CRA business number as soon as you engage with a client in Canada and before the arrival of your employees in Canada.