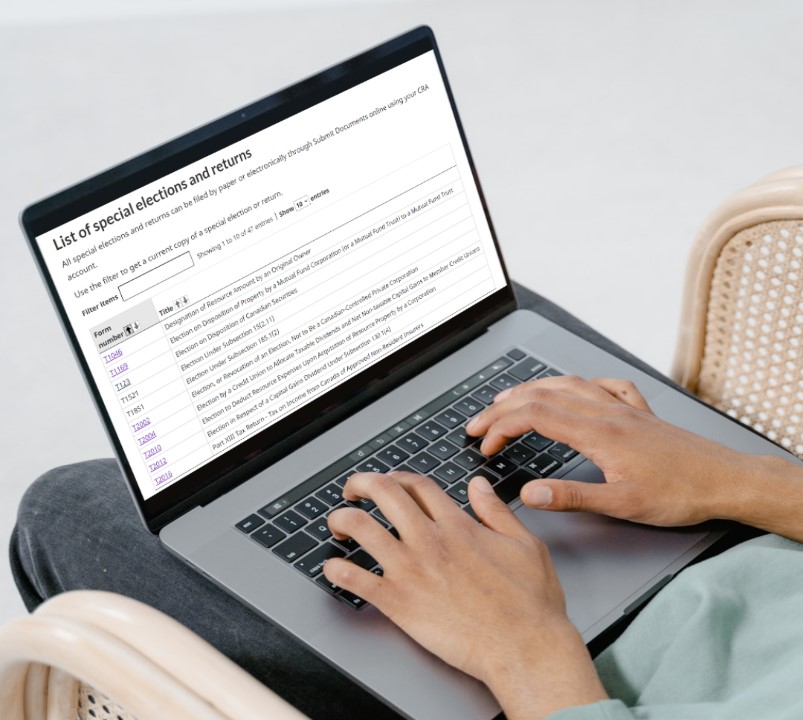

Recently, I explored a complete list of Canada Revenue Agency (CRA) elections after encountering two different situations with my clients.

In one scenario I was helping my client with their late principal residence designation election form, during which I discovered there was no specific area to upload this election on the CRA represent a client portal. After digging more, I was able to find my answer and I thought why not create an extensive list of potential elections. Instead of going through all that trouble of research and clicks again, I decided to create a reference list that I can easily refer to in the future.

Surprisingly, the next morning, I needed this reference list again as a prospective client sought our assistance with Part III tax, specifically the 60% tax on excessive capital dividends (This is an interesting topic that is worthy of its own blog post that’s why I will be uploading it soon). However, when I consulted our list, I realized that there was no readily available prescribed form for this specific election. Although the T2184 form, titled “Election to Deem an Excess Dividend as a Separate Dividend Under Subsection 184(3),” was mentioned, it remained elusive. This is fine because what it means is that I have to file the election in writing and there is no prescribed form for it.

This blog post is designed as your ongoing resource for navigating the complexities of CRA elections. Bookmark it for future reference. For further information, please reach out to us at info@ictax.ca

Common CRA Elections

| Form Number | Election Description | Election Details | Prescribed Form Link |

| T123 | Election on disposition of Canadian securities | For use by a taxpayer to elect under subsection 39(4) of the Income Tax Act that a Canadian security disposed of be considered to have been a capital property. | https://www.canada.ca/en/revenue-agency/services/forms-publications/forms/t123.html |

| T2184 | Election to Deem an Excess Dividend as a Separate Dividend Under Subsection 184(3) | To avoid the 60% tax on excessive capital dividends. | No Prescribed Form |

| T2054 | Election for a Capital Dividend Under Subsection 83(2) | Private corporations can use this form to elect to have the provisions of subsection 83(2) apply to a dividend. For more information, see Income Tax Folio S3-F2-C1, Capital Dividends and Interpretation Bulletin IT-149, Winding-up Dividend | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t2054/t2054-22e.pdf |

| Schedule 089 | Request for Capital Dividend Account Balance Verification | If you are a private corporation, use this schedule to summarize the components making up your capital dividend account (CDA) balance as of the date you specify, on line 003. | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t2sch89/t2sch89-22e.pdf |

| T2057 | Election on Disposition of Property by a Taxpayer to a Taxable Canadian Corporation | This form is used by a taxpayer and a taxable Canadian corporation to jointly elect under subsection 85(1) where the taxpayer has disposed of eligible property under subsection 85(1.1) to the corporation and the taxpayer receives as consideration shares of capital stock of the corporation. | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t2057/t2057-22e.pdf |

| T2058 | Election on Disposition of Property by a Partnership to a Taxable Canadian Corporation | This form is used by a taxable Canadian corporation and all the members of a partnership, to jointly elect under subsection 85(2) where the partnership has disposed of property to the corporation and has received as consideration shares of any class of the capital stock of the corporation. | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t2058/t2058-22e.pdf |

| T2059 | Election on Disposition of Property by a Taxpayer to a Canadian Partnership | This form is used by a taxpayer and a Canadian partnership (of which the taxpayer is a member immediately after the transfer) to jointly elect under subsection 97(2). | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t2059/t2059-22e.pdf |

| T2091 | Designation of a Property as a Principal Residence by an Individual (Other than a Personal Trust) | Use this form to designate a property as a principal residence. You must also complete the “Principal Residence designation” section of Schedule 3 for the year you are in one of the following situations: • you disposed of, or were considered to have disposed of, your principal residence, or any part of it • you granted someone an option to buy your principal residence, or any part of it | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t2091ind/t2091ind-20e.pdf |

| T1255 | Designation of a Property as a Principal Residence by the Legal Representative of a Deceased Individual | Use this form to designate a property as a principal residence. You must also complete the “Principal residence designation” section of Schedule 3 of the deceased person for the year if one of the following applies to the deceased person: • the person disposed of, or was considered to have disposed of, their principal residence, or any part of it • the person granted someone an option to buy their principal residence, or any part of it | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t1255/t1255-20e.pdf |

| T1079 | Designation of a Property as a Principal Residence by a Personal Trust | Use this form to designate a property as a trust’s principal residence. Also, use this form to calculate the capital gain for the year if either of the following situations apply: • the trust disposed of, or the Canada Revenue Agency (CRA) considers the trust to have disposed of, its principal residence or any part of it • the trust gave someone an option to buy the trust’s principal residence or any part of i | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t1079/t1079-22e.pdf |

Other Election

| Form Number | Election Description | Election Details | Form Link |

| T1046 | Designation of Resource Amount by an Original Owner | For use by an original owner of Canadian or foreign resource properties when disposing of all or substantially all of its Canadian or foreign resource properties in circumstances in which subsections 66.7(2.3), (3), (4), or (5) or subsection 1202(2) apply, to designate in favour of the successor an amount, if any, of its: – cumulative Canadian exploration expense (CEE) under clause 66.7(12.1)(a)(i)(B); or – cumulative Canadian development expense (CDE) under clause 66.7(12.1)(b)(i)(B); or – cumulative Canadian oil and gas property expense (COGPE) under clause 66.7(12.1)(c)(i)(B); or – earned depletion base (EDB) under subparagraph 1202(4)(a)(ii); or – cumulative foreign resource expense (FRE) under subparagraph 66.7(13.2)(a)(ii). | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t1046/t1046-16e.pdf |

| T1169 | Election on Disposition of Property by a Mutual Fund Corporation (or a Mutual Fund Trust) to a Mutual Fund Trust | Use this form to elect to have a qualifying exchange under section 132.2 of the Federal Income Tax Act, to transfer all or substantially all of the property of a mutual fund corporation or a mutual fund trust (transferor), to a mutual fund trust (transferee). | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t1169/t1169-fill-18e.pdf |

| T1521 | Election Under Subsection 15(2.11) | No Prescribed Form | |

| T1851 | Election Under Subsection 185.1 (2) | No Prescribed Form | |

| T217 | |||

| T2002 | Election, or Revocation of an Election, not to be a Canadian-controlled Private Corporation (2006 and later tax years) | Use this form to: – elect under subsection 89(11), to be deemed not to be a Canadian-controlled private corporation (CCPC) at any time in or after a tax year under the definition of CCPC in paragraph 125(7)(d), or – revoke under subsection 89(12), as of the end of a tax year, an election previously made under subsection 89(11). | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t2002/t2002-16e.pdf |

| T2004 | Election by a Credit Union to Allocate Taxable Dividends and Net Non-taxable Capital Gains to Member Credit Unions | • For use by a credit union to elect, under subsection 137(5.1) of the Income Tax Act, to allocate to member credit unions the part of the following amounts that can reasonably be attributed to them: – the total of taxable dividends received from taxable Canadian corporations in the year; – the excess of the total of the non-taxable parts of capital gains from dispositions of property in the year over the total of the non-allowable parts of capital losses from dispositions of property in the year (the net non-taxable capital gains); – the amounts allocated for the year to the credit union under subsection 137(5.1) from another credit union that it is a member of. | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t2004/t2004-18e.pdf |

| T2010 | Election to Deduct Resource Expenses Upon Acquisition of Resource Property by a Corporation | Use this election if your corporation has acquired a Canadian or foreign resource property: – to elect under paragraph 66.7(7)(c) or 66.7(8)(c) when the particular property was acquired by way of an amalgamation or windup, other than to which subsection 87(1.2) or 88(1.5) applies; or – to jointly elect with the person from whom it acquired the particular property under paragraph 66.7(7)(e) or 66.7(8)(e) when the property was acquired by a way other than amalgamation or windup. | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t2010/t2010-18e.pdf |

| T2012 | Election in Respect of a Capital Gains Dividend Under Subsection 130.1(4) | A corporation that was, throughout the year, a mortgage investment corporation under subsection 130.1(6) can use this form to elect to have the provisions of subsection 130.1(4) apply to a dividend paid during the period beginning 91 days after the beginning of that year and ending 90 days after the end of that year (referred to on this form as the period) | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t2012/t2012-18e.pdf |

| T2016 | Part XIII Tax Return – Tax on Income from Canada of Approved Non-resident Insurers | For use by a non-resident corporation approved under the Insurance Companies Act to carry on business in Canada, when calculating the non-resident tax payable under Part XIII in accordance with Part VIII of the Income Tax Regulations. | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t2016/t2016-15e.pdf |

| T2022 | Election in Respect of the Sale of Debts Receivable | This form is for the vendor and the purchaser of a business to elect jointly under subsection 22(1) of the Income Tax Act when: – all or substantially all the property used in carrying on the business of the vendor is being sold; – the sale includes all the debts receivable of the business of the vendor; and – the purchaser proposes to continue the business the vendor has been carrying on. | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t2022/t2022-17e.pdf |

| T2023 | Election of a Non-resident Corporation and a Canadian Creditor in Respect of Loans | This form is used by a non-resident parent corporation and a person resident in Canada, or a non-resident insurance corporation carrying on business in Canada (the creditor), from whom the parent corporation has borrowed money that has been loaned, in whole or in part, at the same interest rate, to a subsidiary wholly-owned corporation resident in Canada where all conditions in section 218 apply. | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t2023/t2023-17e.pdf |

| T2024 | No Prescribed Form | ||

| T2027 | Election to Deem Amount of Settlement of a Debt or Obligation on the Winding-Up of a Subsidiary | This form is used by the parent corporation to elect under subsection 80.01(4) where: – the rules in subsection 88(1) apply on the winding-up of a subsidiary corporation; and – a debt or other obligation of the subsidiary to pay an amount to the parent, or of the parent to pay an amount to the subsidiary is settled as a consequence of the winding-up without any payment, or by the payment of an amount that is less than the principal amount and the cost amount of the debt or other obligation of the subsidiary or parent. | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t2027/t2027-17e.pdf |

| T2034 | Election to Establish Inventory Unit Prices for Animals | Use this form if you are an individual, partnership, or corporation engaged in a business that includes the breeding and raising of animals, and you want to elect to use the unit price method to determine the value of animals. | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t2034/t2034-17e.pdf |

| T2046 | Tax Return Where Registration of a Charity is Revoked | You must use Guide RC4424, Completing the Tax Return Where Registration of a Charity is Revoked to fill out this form properly | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t2046/t2046-23e.pdf |

| T2047 | Agreement in Respect of Unpaid Amounts | For use by a debtor and a creditor to file an agreement under paragraph 78(1)(b) of the Income Tax Act in respect of an unpaid amount of a deductible outlay or expense (other than employee remuneration) incurred by the debtor. | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t2047/t2047-15e.pdf |

| T2055 | Election in Respect of a Capital Gains Dividend Under Subsection 131(1) | Use this form to elect to treat a dividend as a capital gains dividend per subsection 131(1), if you are: – a mutual fund corporation as defined under subsection 131(8) throughout the tax year in which a dividend became payable – deemed to be a mutual fund corporation per subsection 131(8.01) – per subsection 130(2), an investment corporation that meets the requirements of subsection 130(3) | https://www.canada.ca/en/revenue-agency/services/forms-publications/forms/t2055.html |

| T2060 | Election for Disposition of Property Upon Cessation of Partnership | For use by members of a Canadian partnership, that has ceased to exist, to jointly elect under subsection 98(3) where all of the partnership property has been distributed to the former members. | https://www.canada.ca/en/revenue-agency/services/forms-publications/forms/t2060.html |

| T2067 | Election not to be a Public Corporation | Use this form if you are a corporation that resides in Canada and you wish to elect not to be a public corporation as defined under subsection 89(1) of the Act. | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t2067/t2067-16e.pdf |

| T2073 | Election to be a Public Corporation | For use by a non-resident insurer (transferor) and a corporation (transferee), that is a qualified related corporation (within the meaning assigned by subsection 219(8)) to jointly elect under subsection 138(11.5) in respect of a transfer of an insurance business where: – the transferor has, at any time in a tax year, ceased to carry on all or substantially all of an insurance business carried on by it in Canada; and – the transferor has, at the time of cessation or within 60 days thereafter, transferred all or substantially all of the property owned by it and that was designated insurance property in respect of the business for the tax year; and (a) the transferee, immediately after the time of cessation, commenced to carry on that insurance business in Canada; and (b) the consideration for the transfer includes shares of the capital stock of the transferee | https://www.canada.ca/en/revenue-agency/services/forms-publications/forms/t2073.html |

| T2076 | Valuation Day Value Election for Capital Properties Owned on December 31, 1971 | For use by an individual when electing under subsection 26(7) of the Income Tax Application Rules, 1971, in the year in which the first disposition of capital property owned by the individual on December 31, 1971, occurs, except capital property disposed of for the same amount as its fair market value on valuation day. | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t2076/t2076-00e.pdf |

| T2079 | Election Re: Expropriation Assets Acquired as Compensation for, or as Consideration for Sale of, Foreign Property Taken by or Sold to Foreign Issuer | For use by a taxpayer resident in Canada to elect under section 80.1 where shares of the capital stock of a foreign affiliate carrying on a business in a foreign country or all or substantially all of the property used by the taxpayer in carrying on a business in a foreign country (foreign property) are taken or sold under the authority of the law of that foreign country and the taxpayer acquires as compensation any bonds, debentures, mortgages, hypothecary claims, notes or similar obligations (expropriation assets) issued or guaranteed by the government of the foreign country. | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t2079/t2079-16e.pdf |

| T2096 | Part XII.1 Tax Return – Tax on Carved-out Income (2006 and later tax years) | Use this form if you are liable to pay tax under Part XII.1, on income received from a carved-out property as defined in subsection 209(1). | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t2096/t2096-17e.pdf |

| T2100 | Joint Election in Respect of an Insurance Business Transferred by a Non-Resident Insurer | Fill out this form to file an annual return for a labor-sponsored venture capital corporation (LSVCC) that is registered under Part X.3 or is a revoked corporation. Fill out Form T2152A, Part X.3 Tax Return and Request for a Refund for a Labour-Sponsored Venture Capital Corporation, to claim a refund under subsection 204.83(1). | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t2100/t2100-16e.pdf |

| T2101 | Election for Gains on Shares of a Corporation Becoming Public | This form is for use by individuals who own capital property that is a share of a class of the capital stock of a corporation that is a small business corporation at that time to elect under section 48.1 when the corporation ceases to be a small business corporation because its or another corporation’s class of shares is listed on a designated stock exchange. | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t2101/t2101-15e.pdf |

| T2107 | Election for a Disposition of Shares in a Foreign Affiliate | For use by a corporation resident in Canada to elect under subsection 93(1) of the Income Tax Act for the disposition of shares in a foreign affiliate or such disposition by another foreign affiliate. | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t2107/t2107-15e.pdf |

| T2140 | Part V Tax Return – Tax on Non-qualified Investments of a Registered Charity | Use this form if you are liable to pay tax under subsection 189(1). You are liable to pay tax if interest paid within 30 days after the tax year end on a debt owing on a non-qualified investment to a registered charity that is a private foundation was less than the amount of interest that would be payable on the debt calculated using prescribed rates. | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t2140/t2140-17e.pdf |

| T2123 | Election Under Subsection 212.3(3) | No Prescribed Form | |

| T2141 | Part II.1 Tax Return – Tax on Corporate Distributions | For use by a corporation (other than a mutual fund corporation) that was a public corporation or resident in Canada and had a class of outstanding shares that were purchased and sold in the manner in which such shares normally are purchased and sold by any public member in the open market. | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t2141/t2141-15e.pdf |

| T2142 | Part XII.3 Tax Return Tax on Investment Income of Life Insurers (2016 and later tax years) | If you are a life insurer, use this return to calculate the Part XII.3 tax on taxable Canadian life investment income for the year | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t2142/t2142-23e.pdf |

| T2143 | Election not to be a Restricted Financial Institution | Use this form if you are a corporation that is a mutual fund corporation or an investment corporation and you want to elect not to be a restricted financial institution under subsection 131(10) of the Income Tax Act. | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t2143/t2143-16e.pdf |

| T2152 | Part X.3 Tax Return for a Labour-Sponsored Venture Capital Corporation | When a commercial obligation is settled for less than its principal amount, the forgiven amount must be accounted for by the debtor under the rules in section 80. If after applying subsections 80(3) and (4), the debtor has designated the forgiven amount to the maximum allowed under subsections 80(5) to (10), section 80.04 allows the debtor to transfer any of the remaining unapplied forgiven amounts to an eligible transferee (certain corporations and partnerships to which the debtor is related), as agreed by the parties. | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t2152/t2152-22e.pdf |

| T2152A | Part X.3 Tax Return and Request for a Refund for a Labour-Sponsored Venture Capital Corporation | Fill out this form to apply for a refund under subsection 204.83(1) at a time other than when you are filing an annual Part X.3 return (Form T2152). Fill out this form to file an annual return for the tax year in which tax becomes payable under subsection 204.82(5) or 204.85(2) if your labour-sponsored venture capital corporation (LSVCC) is prescribed for the purpose of section 127.4(1), is not registered under Part X.3, and is not a revoked corporation. | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t2152a/t2152a-22e.pdf |

| T2156 | Agreement to Transfer a Forgiven Amount Under Section 80.04 | For use by the trustee of a trust governed by an employees profit-sharing plan to elect under subsection 144(4.2) of the Income Tax Act | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t2156/t2156-17e.pdf |

| T2185 | Election on Disposition of Property by a Segregated Fund Trust to a Related Segregated Fund Trust | Use this form to elect to have a qualifying transfer of property under section 138.2 to transfer all of the property of a related segregated fund trust (transferor) to a related segregated fund trust (transferee). | https://www.canada.ca/en/revenue-agency/services/forms-publications/forms/t2185.html |

| T2311 | Election Under Subsection 212.3(11) | No Prescribed Form | |

| T3009 | Election for Deemed Disposition and Reacquisition of Capital Property of a Trust Governed by an Employees Profit Sharing Plan Under Subsection 144(4.2) | Designation of the forgiven amount by the debtor – Subsections 80(5) to 80(11) | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t3009/t3009-08e.pdf |

| T3018 | Election for Deemed Disposition and Reacquisition of Capital Property of a For Departmental Use Only Life Insurance Segregated Fund Under Subsection 138.1(4) | For use by the trustee of a life insurance segregated fund trust to elect under subsection 138.1(4) of the Income Tax Act, where a policyholder withdraws all or part of his/her interest in a segregated fund policy. | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t3018/t3018-06e.pdf |

| T913 | Part XI.2 Tax Return –Tax for the Disposition of Certain Properties | Use this form if you are an institution, a public authority, a charity, a municipality in Canada, or a municipal or a public body performing a function of government in Canada that disposes of, or changes the use of, certain property. | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t913/t913-16e.pdf |

| T2153 | “Designation under Paragraph 80(2)(i) when two or more commercial obligations are settled at the same time | When a commercial obligation is settled for less than its principal amount, the forgiven amount must be accounted for by the debtor under the rules in section 80. The forgiven amount is defined in subsection 80(1). | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t2153/t2153-11e.pdf |

| T2154 | Designation of forgiven amount by the debtor – Subsections 80(5) to 80(11) | When a commercial obligation is settled for less than its principal amount, the debtor has to account for the forgiven amount under the rules in section 80. Forgiven amount is defined in subsection 80(1). As the debtor, you must first apply the forgiven amount to reduce any losses carried forward from previous years in the order specified in subsections 80(3) and (4). | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t2154/t2154-09e.pdf |

| T2155 | Alternative Treatment of Capital Gains Arising under Section 80.03 on Settlement of Debt | When you as a debtor surrender a capital property (other than a distress preferred share) that is a share, a capital interest in a trust, or an interest in a partnership, you will be considered to have a capital gain from the disposition at that time. The amount of the capital gain is based on the calculation in subsection 80.03(2). Surrender of capital property is defined in subsection 80. | https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/t2155/t2155-11e.pdf |