By Haroon Khan, CPA, CA (Canada), CPA (USA)

I can still vividly recall the time when I was working on my first deferred income tax provision according to the International Financial Reporting Standards (IFRS) guidelines, specifically IAS12. It was, during my tenure as a Senior Associate at KPMG when I was assigned the task of auditing the deferred income tax provision for George Weston Limited and Loblaw Companies Ltd. Initially I felt a bit anxious upon reviewing the working papers as I was not quite sure how to begin with the auditing process. However, that experience made me realize that every tax accountant should possess an understanding of the steps involved in completing a deferred income tax provision.

Throughout my career, I’ve had conversations with skilled tax accountants and what stuns me is that many of them don’t feel entirely comfortable handling a deferred income tax provision. I believe the reason for this is the complicated templates provided by the company.

In this blog post, we will delve into each step required to prepare a deferred income tax provision. If these steps appear challenging, we recommend considering our CPD hours course which provides in-depth guidance. Alternatively, you can also engage our services as your trusted tax accountants who specialize in simplifying the preparation process for your income tax provision files. We have established ourselves as advisors for public corporations.

Steps to Complete the Deferred Income Tax Provision

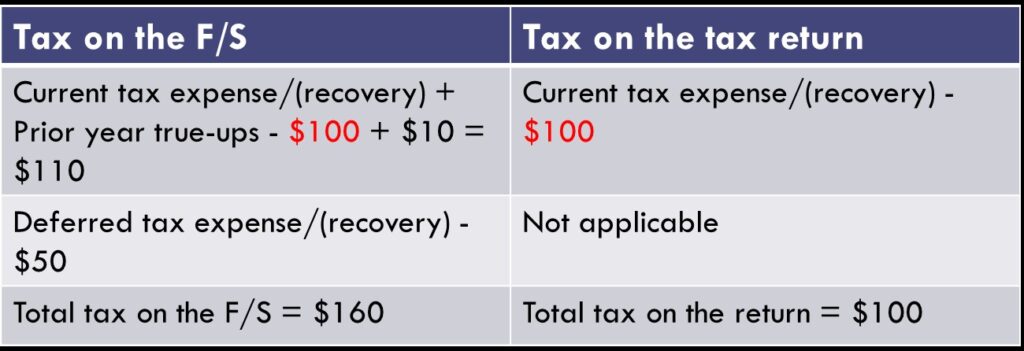

To complete the Deferred Income Tax Provision, we need to follow the steps outlined below. It’s important to understand that the tax expense reported in the statements might not necessarily match the tax return as shown in the table provided.

Step 1: Calculate the Current Tax Expense

To determine the current tax expense, start by computing the taxable income. This taxable income should align with the taxable income calculated for the Corporate Tax Return (T2). The only difference lies in how you present the tax adjustments to arrive at the taxable income. When calculating taxable income, for a tax return we make Schedule 1 adjustments to reconcile accounting income with net income for tax purposes without categorizing them as permanent or temporary differences. However, for the purpose of Tax Provision, it’s important to distinguish between temporary and Permanent differences. The actual amount of taxable income remains unchanged.

Once you have determined taxable income multiply it by the tax rates to arrive at gross tax or current tax expense.

Step 2: Complete Provision to Return (Book to File) Adjustments:

It’s crucial to note that the current tax expense reported in the financial statements may not always align with that reported in the tax return. This discrepancy is due to what we refer to as “Prior Year true-ups.”

The true-ups come into play when there are differences between the current tax expenses calculated during tax provision preparation and those reported in the tax return. This discrepancy is more common among huge corporations since materiality thresholds are typically considered during the tax provision processes. However, materiality thresholds do not have the same impact on tax return preparation.

In essence, these true-ups ensure that financial statements accurately reflect a company’s tax position and align with the information provided in their tax returns resulting in an all-inclusive transparent view of their overall tax expense.

3. Work on the Deferred Income Tax Asset/Liability Schedule:

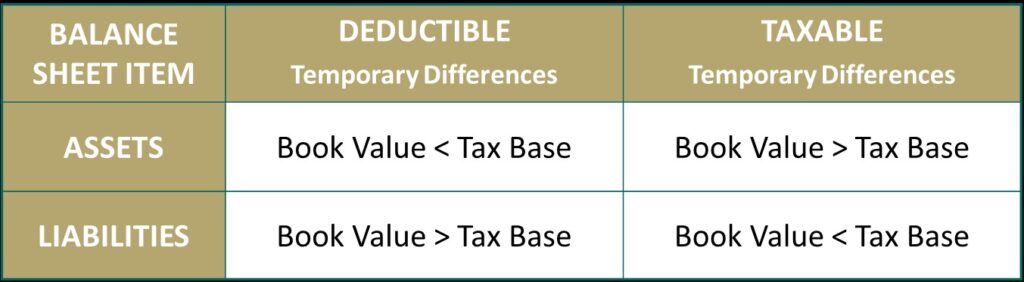

Focus on working on the Deferred Income Tax Asset/Liability Schedule, which is a concept of tax accounting and does not apply to preparing your actual tax returns. We tend to make a comparison between the accounting basis for an asset/liability and the tax basis. Let’s take an example of Property, Plant, and Equipment (PP&E).

In this scenario you will present the accounting basis, which should align with the Net Book Value (NBV) for accounting purposes. On the other hand, the tax basis is represented by the UCC balance as per the tax return. The difference between these two bases creates what we refer to as deductible or taxable differences. A representation of this concept can be observed below:

After identifying these temporary differences, the next step involves multiplying these amounts by the relevant tax rate to calculate either deferred tax asset (DTA) or liability (DTL). It’s important to note that this tax rate might differ from the rate used in Step 1. This variation occurs because when calculating deferred tax assets and liabilities we consider tax rates and any legislative changes that could affect the company’s tax obligations i.e., future tax rates.

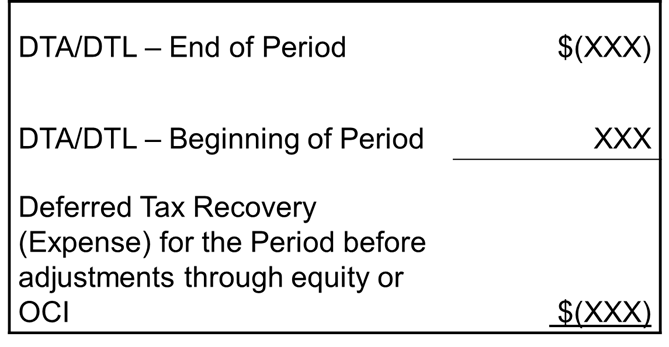

Once you are done calculating DTA and DTL it’s time to determine the deferred tax expense or recovery. As shown in the table below you can assess the year over year change in DTA and DTL to ascertain the deferred tax expense, for financial statement purposes.

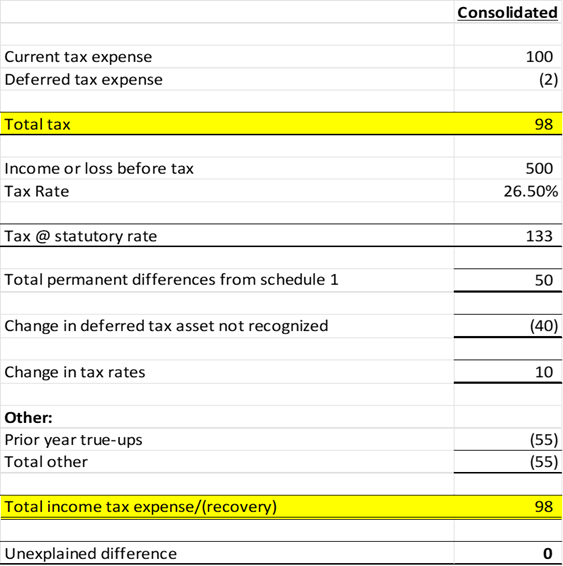

4. Conduct a Rate Reconciliation;

Rate reconciliation plays an important role in the process. It aligns the net income before tax for financial accounting, multiplied by the tax rate with the current and deferred tax expense/(recovery) that will be reported on the financial statements. This reconciliation serves as a check to ensure the accuracy of all your calculations.

The format usually resembles the example given below:

5. Finalize Income Tax Payable/Receivable Roll;

Before moving on to prepare the tax note, the final step is computing the income tax payable/receivable amount. The critical aspect of this computation is reconciling the opening balance i.e., the prior year’s income tax payable/(receivable) balance. It is essential to make sure that the opening balance has been correctly cleared and accounted for.

This reconciliation process typically takes place at the end of calculating taxes because it doesn’t affect any calculations or alter the content of the tax note. Its purpose is to serve as a check ensuring that all financial figures related to income tax receivables or payables are accurate and properly represented in the company’s statements.

6. Share Tax Journal Entries, with Your Accounting Team;

Once you have completed all calculations and reconciliations it’s time to convey your findings to your accounting team. These journal entries will ensure that the tax figures accurately reflect in the company’s records.

7. Prepare the Tax Notes and Disclosures for the Financial Statements;

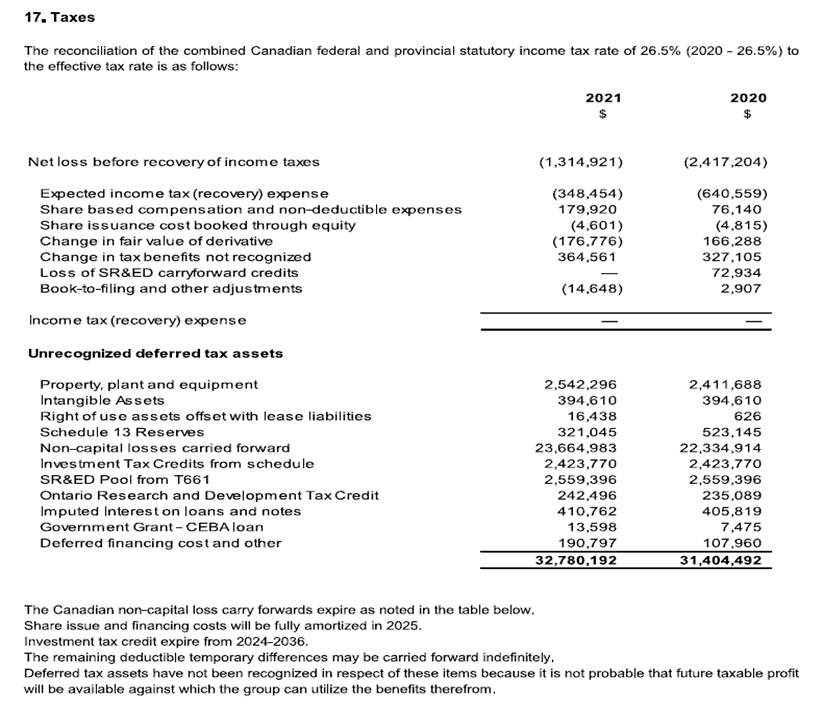

The information presented in the income tax note should match with the figures reported in both the statement of financial position and the income statement. To demonstrate this alignment here is a sample tax note:

Conclusion:

Having a grasp of the income tax provision is crucial for any tax accountant. Although it may initially seem daunting, breaking it down into these seven steps can make the process more manageable. If you still find it challenging, consider enrolling in our course that is offered through cpdhours.com for guidance or alternatively, you can engage our services as your tax accountants to prepare or simplify your deferred income tax provision documents. We are trusted advisors to many public corporations.

Feel free to contact our team of tax experts at info@ictax.ca