This blog post will explain the applicable accounting standards for the calculation of deferred and future income tax. We will explore the key distinctions, between these standards.

To begin with, it’s important to note that if you’re a public corporation in Canada you must adhere to IFRS for reporting purposes. Therefore, IAS 12 is the relevant standard for reporting income taxes on your statements.

However, if you’re a private corporation in Canada you have the option to choose between adopting IFRS or ASPE. If you decide to go with ASPE then use ASPE 3465, as the accounting standard for reporting income taxes on your statements.

Tax Accounting standards

If you are preparing a deferred income tax provision with IFRS then for guidance the relevant handbook section is IAS 12, Income Taxes. This section particularly addresses the reporting for current and deferred tax transactions, thus prescribing the appropriate accounting treatment for income taxes. In situations, where IAS 12 is silent on the tax treatment of any transaction then IAS 12 specifies where to find additional guidance in the handbook. For example, paragraph 4 of IAS 12 directs readers to refer to IAS 20 when dealing with accounting, for government grants. It states “This standard does not cover the methods of accounting for government grants (IAS 20 deals with accounting, for government grants and disclosure of government assistance) or investment tax credits. However, this standard does address how to account for differences that may arise from government grants or credits.”

If you are preparing an income tax provision under ASPE you can refer to ASPE 3465 Income Taxes, for guidance. Similar to IAS 12 this section may also provide cross references to sections within the handbook.

Terminology: IAS 12 vs. ASPE3465

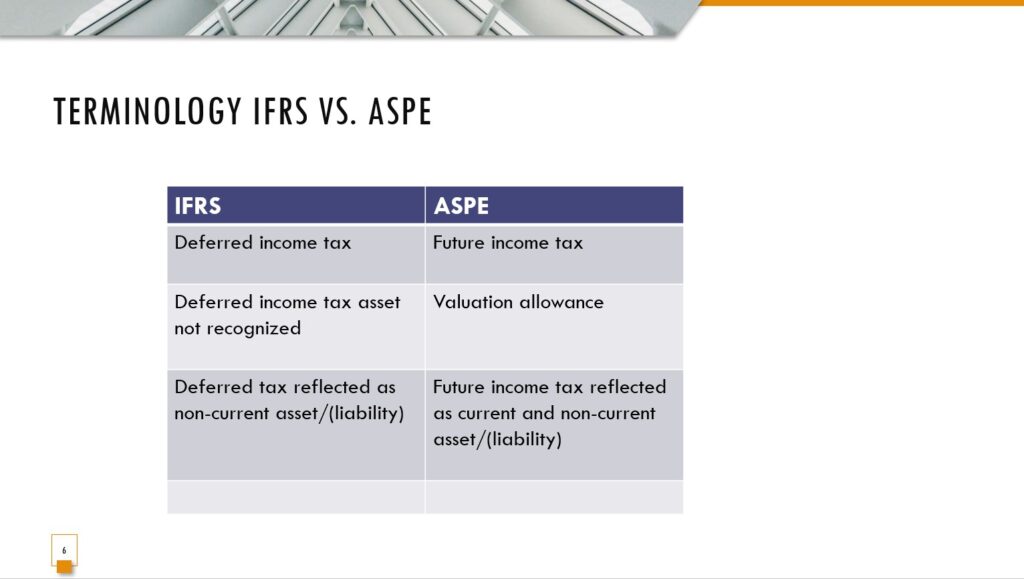

Differences in terminology exist between IAS 12 and ASPE 3465. Under IAS 12 the term used is ‘deferred income tax,’ while ASPE uses the term ‘future income tax.’

In future blogs, you will explore that to recognize deferred tax assets you need to evaluate whether the entity will be able to generate adequate future taxable income for the utilization of the asset. If it is expected that sufficient taxable income will not be generated, both standards state that the asset should not be recognized. In IAS terminology this is referred to as a ‘deferred income tax asset not recognized,’ whereas ASPE terms it a ‘valuation allowance.’

IFRS and ASPE record deferred tax assets or liabilities differently. These assets are categorized as non-current by IFRS. While ASPE does not provide guidelines for their presentation. Depending on the expected timing of realization or settlement entities have the flexibility to present them as either non-current assets or liabilities.

Calculation: IAS 12 vs. ASPE 3465

One difference between IAS 12 and ASPE 3465 lies in the choice of method used for accounting income taxes. Under ASPE 3465 there are two methods

1. Deferral Method: This is the default approach under ASPE 3465. With this method, income taxes are recognized when they become payable or recoverable in periods. It means that temporary differences between the accounting and tax values of assets and liabilities are acknowledged, and any associated income tax implications are postponed until they are expected to be settled or realized. On the balance sheet deferred tax assets and liabilities reflect these anticipated tax consequences.

2. Taxes Payable Method: Alternatively private enterprises can opt for the tax method. In this approach, income taxes are recognized in the period, as the related income and expenses. Basically, income taxes are acknowledged in the present and not as deferred. This approach makes accounting for income taxes simpler as it removes the requirement to calculate and record deferred tax assets and liabilities.

Conversely, IAS 12 does not offer a choice, for a tax method. AS 12 requires the utilization of the balance sheet liability method, which necessitates recognizing tax assets and liabilities for all temporary differences.